Insights

Explore our collection of thought-provoking articles and stay informed about the latest trends, best practices, and insightful perspectives with expert advice from the 360 team.

Maximizing your 2023 Mandatory Target

Background On June 28, 2022 the Alberta Energy Regulator released its industry-wide mandatory liability spending target. The 2023 target was set in July 2021 at $443MM, however the AER surprised industry with a significant revision to $700MM. Bulletin 2021-23 Bulletin 2022-23 The full AER Bulletin 2022-23 can be found HERE The AER notes rising commodity…

The ABC’s of British Columbia’s Dormant Sites

It’s been three years since the inception of the Dormancy and Shutdown Regulation in BC and boy has it affected my job as an environmental consultant! On the heels of the 2019 Redwater decision, BC regulators took a strong stance against pushing liabilities down the road by regulating site closure timelines to persuade the oil…

Is this still good? The Best Before/Sell by/Meilleur Avant date of your Phase 1 ESA Report

I had a colleague in the abandonment pod ask me “when does a Phase 1 ESA expire?”. They had a client that was interested in submitting an SRP (Site Rehabilitation Program) application for both abandonment and environmental scopes of work – but wanted to estimate the environmental work on a Phase 1 Environmental Site Assessment…

Curious Minds: How childhood wonder has inspired innovative and empathetic decision-making, and collaborative team efforts

“In my home province, milk was most often sold in bags and inserted into open-top jugs. My parents would cut a tiny corner out of the front and the back of the bag before pouring. Somewhere along the way, I picked up this habit. It hadn’t occurred to me to question the process until I,…

Client Obsession: It’s importance across all aspects of the business

From a young age, I was taught about the significance of going that extra mile. This had many applications through my life like sports, school, relationships, and in business. In various sports growing up, we would aim for that extra inch to set us apart which led to multiple city championships and a provincial championship.…

360’s 2022 ESG Report

February is always an exciting month for 360 as it is the release of our annual ESG Report. 2022 marks the 3rd release of our ESG Report, which highlights our successes from the past year and outlines our future goals in the areas of Environment, Social, and Governance. The theme of our 2022 report is “Building a…

The Holistic Approach: Directive 088

We hear the word holistic used in many places. Project management, mechanical diagnoses and more commonly, our health. A holistic approach can be incredibly beneficial when it comes to our health. We are examining ourselves as a whole rather than individual parts. When all those individual parts are taken care of, as a whole we…

The Evolution of Closure in Western Canada

Have you ever wondered what it would like to be a first-hand witness to evolution as it happens? Anyone living in Western Canada should take a few moments to read this Insight, and learn how the oil and gas sector has adapted and evolved to make Closure a vital part of its operational framework. Closure…

Taking the Time it Takes

My dad first said this to me when I was around 10 years old. I can’t remember the exact task that I was trying to complete in a hurry, but I was in a rush, nonetheless. I was given this advice and at the time, it seemed like one more thing your parent says to…

Let’s Talk about Mental Wellbeing

Have you asked your friends lately how they are doing, and REALLY listened to the answer? This article has nothing to do with oil and gas site closure and I am not a qualified health professional. With the disclaimers out of the way, we can now chat about something that I hope hits your radar…

Closure’s Triple Threat: Balancing Liability Requirements, Financial Performance and ESG

The Alberta Oil and Gas industry is facing a triple threat. No, we are not talking about the famous actor, dancer and singer Patrick Swayze (who just happens to be 360’s beloved role model). What we’re facing even the legendary Johnny Castle himself can’t dance around. This threat is a combination of changes in regulations…

Saskatchewan updates Oil & Gas Conservation Regulations to accommodate Closure Companies in new Oil & Gas Liability Management Regulations

“Qualifying expenditures approved by the minister as a result of a license transfer to a closure company may be applied against the transferor’s Annual Reduction Target (ART)” Background On July 5, 2021, the Ministry of Energy and Resources released Bulletin BT2021-010 outlining the new Financial Security and Site Closure Regulations along with amendments to…

A Brief Guide to Abandonment Language

As Canada is officially bilingual, oil patch language and corresponding regulations can appear the same, with two ways to describe the same thing. June’s Insight explores some of this language across jurisdictions in which we operate. In Western Canada, most of us are familiar with the abandonment vernacular like groundwater protection, bridge plugs, cement caps,…

The Impacts of Federal Funding for Closure in Western Canada: An interim report on the impacts of $1.7B in federal funding injections

As May marks the 1-year milestone for the federal funding initiatives designed to assist with site closure, we look back at some of the lessons learned over the first year and position for the remaining 20 months of the program(s). A bit of Chaos We think it is fair to say that the energy sector…

Diversity, Servitude and Grit – What Rugby Can Teach Us About Business and Life

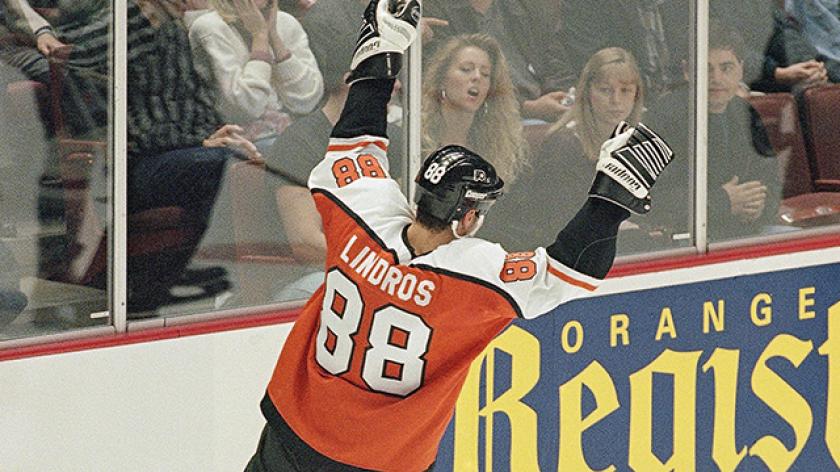

*Pictured above – Pat Riordan, Captain of the Canadian Rugby Team 2011 Rugby World Cup. Embodied the traits that are exposed through rugby. Rugby is a beautiful, brutal, intellectual, and inspiring sport. Our team here at 360 has produced many fantastic insights on topics relevant to the world of Oil and Gas Liability and ARO. …

Applying Environmental Risk Intelligence and Data-Driven Solutions to Make Complex Site Closure Simple

This month’s Insight is a virtual presentation by 360’s Manager of Environmental Strategy, Andrea Bullinger, and Senior Risk Assessor, Brandon Smith. While presenting at the AGAT Laboratories Tech Talks, they dive deep into how applying environmental risk intelligence and data-driven solutions help make complex site closure simple. Click HERE to watch.

360’s Second Annual ESG Report

Click here to see the full report – 360’s 2021 ESG Report We are very excited to release our 2021 ESG Report to the industry. This is our 2nd Annual ESG report, and we are proud to showcase the accomplishments we achieved in 2020, but more importantly highlight our ESG goals we have established for…

Piano Players, Piano Movers and the Alberta Liability Management Framework

The big question that has started to creep into our conversations as of late is “what drives site closure in Alberta once the Federal Government funded Site Rehabilitation Program (SRP) ends and the new Liability Management Framework (LMF) is fully implemented?” As I ruminate on that, I’d say that in general, I try to simplify…

2020 Year in Review – Legacy Liability Takes a Front Seat

Without going out on a limb here, we think it is safe to say that 2020 has been another chaotic year for the energy industry in Canada. At a macro-level, we’ve witnessed sub-zero commodity prices, a global pandemic, mounting pressure from the worldwide ES&G movement, political upheaval south of the border, and our own version…

Let’s Make a Deal: Opportunities and Concerns with E&P Consolidation

It has been two years since we last wrote about some of the hurdles facing acquisitions and dispositions in the oil & gas sector. In 2018 it was Statement of Concerns and objections to Notice of Assignments. I regret to report that the list of hurdles has only grown since then. Maybe I am an optimist, but I have not lost…