It has been two years since we last wrote about some of the hurdles facing acquisitions and dispositions in the oil & gas sector. In 2018 it was Statement of Concerns and objections to Notice of Assignments. I regret to report that the list of hurdles has only grown since then. Maybe I am an optimist, but I have not lost hope for deals just yet.

The M&A market struggled through 2019 with producer’s inability to access either the debt or equity markets to fund transactions. This was compounded by the spread in what a seller considered to be an acceptable asset value versus what a buyer was willing to pay for the asset. In instances where the first two hurdles could be cleared and a transaction entered the due diligence phase, it generally fell apart due to legacy liability concerns. Throw in a global pandemic and a collapse in oil prices in 2020 and we have ourselves a party. A really depressing party. All of this culminates into an incredibly challenging time to close a deal.

YET! Over the past two months, we have seen some major consolidation happening in the oil & gas sector in both Canada and United States, as well as clever solutions for deals weighed down by liability. We are starting to hear almost weekly announcements of corporate mergers or acquisitions, driven by lenders and management teams looking for comfort with scale. A new market has also developed, driven by liability acquisition companies looking to provide a solution to stranded assets and stalled transactions. In all instances, producers are finding new ways to survive after six years churning away in an oil downturn. These major consolidations are re-shaping the energy landscape in Western Canada and even though there will be downside to this, my rose-colored glasses see an ultimate net benefit.

Last month my colleague Mike Newton wrote about the need for clarity when evaluating Asset Retirement Obligations (ARO). Industry lacks a standardized approach so we will be keen to understand how liability is being evaluated in these major transactions from an internal and external perspective. We will also seek to understand how two companies navigate the data merge of ARO reports that have different underlying methodologies for calculating ARO. This recent M&A activity reinforces the need for an industry accepted ARO methodology to avoid discrepancies and ensure liability data is blended seamlessly for financial reporting purposes.

Now back to why I am still optimistic. When large companies start to consolidate, a re-evaluation of assets follows. The executives decide the focus of the new company and align the assets to fit that vision. Ideally, this opens underutilized assets for disposition opportunities. A prime example of this is the Husky and Cenovus transaction, followed shortly after by the Cenovus to Headwater disposition. Once neglected assets are now in control by management teams with access to capital that pursue development at a quicker pace than their predecessors. This infusion of capital and development trickles down to all facets of the energy sector, including the closure space. The number of active companies is shrinking but with that we can still get some reinvigoration in to assets that have been held by traditionally conservative producers.

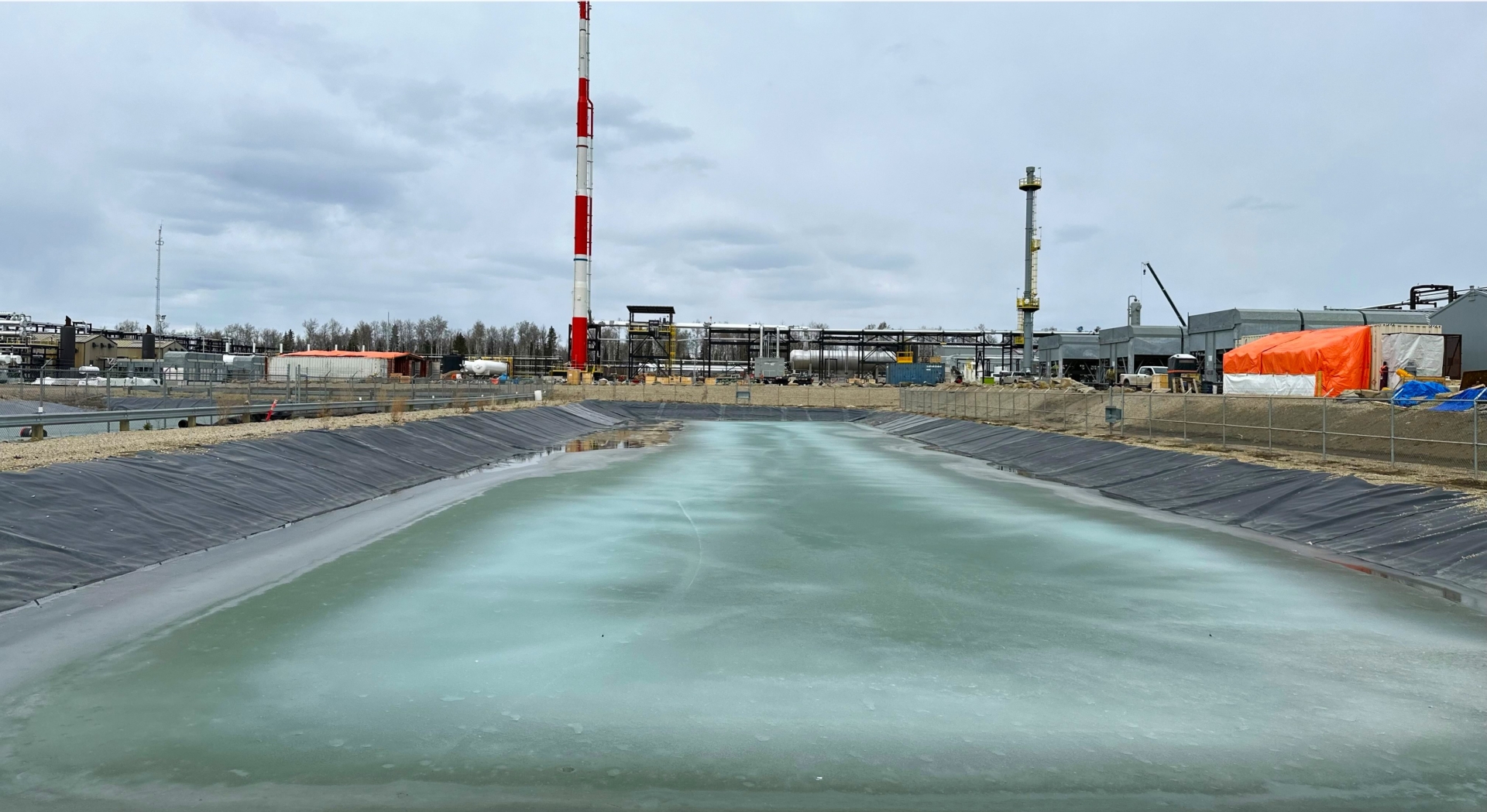

In recent years we have seen a heightened focus on oil & gas liability from producers, investors, regulators, governments, and the public. The situation is ripe for innovation and the Western Canadian energy industry is uniquely positioned to lead the global charge in tackling legacy liability. We have a window of opportunity to flip the negative narrative surrounding oil & gas development and showcase the quality changes energy companies are implementing. As the industry continues to consolidate, I am hopeful we can rally together and find a common voice in this regard.

-Lindy

Please contact Lindy Couillard at lcouillard@360eec.com or (403) 869-5463 to discuss this article or the current M&A market. Or at lcouillard@skye-ar.com to discuss the Skye Asset Retirement liability transfer model.

About the Author

Lindy Couillard, Managing Director – Skye Asset Retirement

Lindy is an Energy Professional with over 19 years of progressive accomplishments in major Asset Exchanges, Acquisition & Divestitures, Contract Analysis, and Administration. She obtained a Bachelor of Commerce from the University of Calgary, majoring in Petroleum Land Management. After spending her career working for energy producers, she joined the 360 team in 2018 to support 360’s corporate development, strategic planning and governance solutions. Lindy led the Corporate Services team, providing foundational business services to support 360’s growth. In 2024 she shifted her focus from 360 to growing our sister company, Skye Asset Retirement.