Introduction

The intersection of science and business is evolving at an unprecedented pace, especially in the environmental sector. As the global community faces the intensifying challenges of climate change, resource depletion, and environmental degradation, the demand for sustainable solutions has become more urgent than ever. Over the past 25 years, the environmental industry has emerged as a key economic driver at municipal, provincial, national, and international levels.

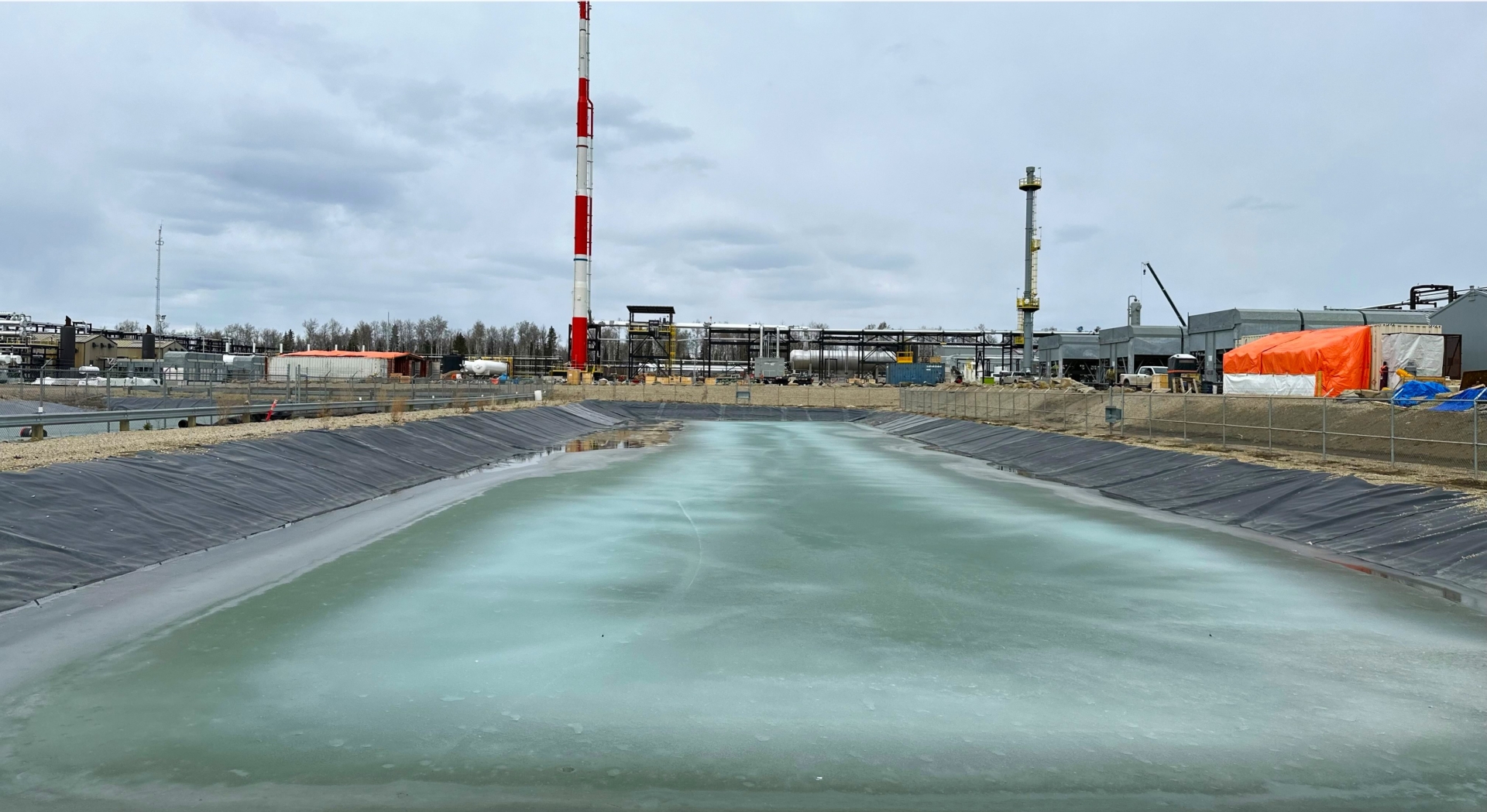

Historically, Western Canada’s environmental sector has been closely tied to oil and gas. However, the rise of other industries—mining, agriculture, manufacturing, forestry, and clean energy—has broadened the environmental sector’s scope significantly. This diversification presents new opportunities for environmental firms to drive innovation, create jobs, and build resilience against cyclical commodity markets.

This insight explores the expanding opportunities within these sectors and how they contribute to sustainable growth beyond traditional oil and gas development.

Sector Opportunities and Market Trends

Mining

The mining industry is a major contributor to Canada’s economy, accounting for $107 billion in GDP in 2023 and employing over 700,000 people directly and indirectly. However, it also brings substantial environmental challenges, including land degradation, water contamination, and greenhouse gas emissions.

There is growing demand for sustainable mining practices, such as dry tailings, water recycling, and minimal disturbance techniques. These practices are increasingly becoming regulatory requirements and investment criteria. As a result, engineering and environmental firms specializing in reclamation, environmental monitoring, and ESG compliance are seeing increased demand. This sector is projected to grow by 5.2% annually in environmental services through 2030.

Agriculture

Agriculture is another sector with significant environmental implications, consuming 70% of global freshwater and contributing to nearly 25% of global greenhouse gas emissions. In Canada, the movement toward sustainable agriculture—such as precision farming, reduced pesticide use, regenerative practices, and agroforestry—is gaining momentum.

Environmental consulting firms are playing a key role in helping producers manage compliance, improve soil health, and monitor water and nutrient usage. As food security and sustainability rise on the global agenda, environmental service providers will find increased opportunities in supporting these transitions.

Manufacturing

Manufacturing contributes approximately 11% of Canada’s GDP, but it also generates substantial emissions and waste. With growing pressure from both regulators and consumers, companies are implementing life cycle assessments (LCAs), energy efficiency upgrades, and circular economy principles.

Environmental firms that specialize in waste management strategies, carbon footprint assessments, and ISO 14001 compliance will find a growing client base in this sector. The Canadian manufacturing industry is projected to reduce its carbon intensity by 40% by 2030, which will require substantial external expertise.

Forestry

Canada’s forest sector is responsible for managing 347 million hectares of forest land, and it contributes over $25 billion annually to the economy. Forestry is intricately tied to climate regulation, biodiversity, and water management. Sustainable forestry practices—like selective logging, reforestation, and afforestation—are essential for ecosystem stability.

The push toward sustainable certification is creating new market standards that require robust environmental monitoring and compliance services. Forestry companies increasingly rely on environmental professionals for ecological assessments, carbon credit development, and biodiversity tracking.

Clean Energy

Clean energy is one of the fastest-growing industries globally, with Canada targeting net-zero emissions by 2050. Investments in wind, solar, hydro, and energy storage reached over $20 billion in 2023, with continued annual growth expected.

Environmental professionals are critical in site selection, permitting, impact assessments, and long-term monitoring. Companies that expand their services into the clean energy sector will not only tap into a growing market but also align with long-term sustainability goals and policy incentives.

Strategic Outlook

For 360, the environmental sector’s expansion offers a path to sustained growth, resilience, and leadership beyond the traditional oil and gas markets. By building capacity in mining, agriculture, manufacturing, forestry, and clean energy, we can:

- Diversify our client base and revenue streams

- Reduce exposure to oil and gas market volatility

- Position ourselves as a multidisciplinary leader in sustainability

- Support Canada’s transition to a low-carbon economy

By leveraging our existing expertise and expanding into complementary industries, 360 can create a balanced, future-ready portfolio that supports economic development while protecting the environment.

Thanks for reading,

Matt

About the Author

Matthew Hamilton, B.Sc., RT Ag, Manager, Edmonton Environmental Services

Matthew Hamilton is a highly experienced environmental professional with 18 years in the field of remediation and land reclamation. Holding a Bachelor of Science in Biological Sciences and designation as a Registered Technologist in Agrology (RT Ag), Matthew specializes in leading reclamation projects across Western Canada, including significant experience in the oil and gas sector.