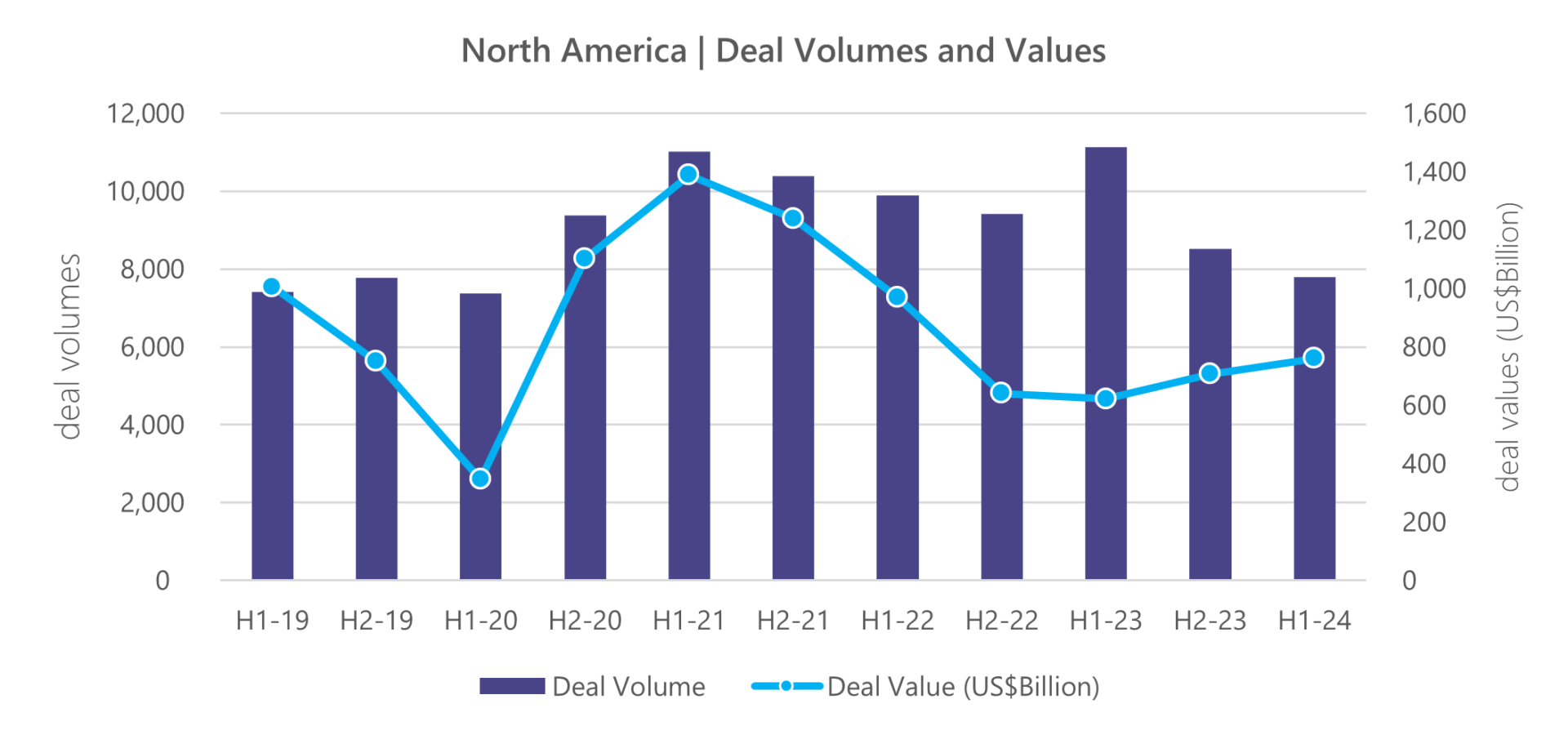

Mergers and Acquisitions (M&A) activity in North America continues to display a slowdown in deal volumes throughout 2024. This trend is particularly striking given the optimism for increased deal-making at the outset of the year. The key question remains: is this the beginning of a more measured approach to deal-making, or will we witness the start of a rebound in the second half of the year?

Source: PwC 2024 Mid-Year Outlook

The latest data from PwC offers valuable insights into the current state of the M&A landscape. While deal values have been steadily rising since the beginning of 2023, deal volumes have decoupled from this trend, showing a noticeable decline over the same time frame. Considering the current economic climate, this is an ideal time to explore the key macroeconomic factors contributing to this shift.

Current Macro Trends in M&A Activity

- Drop in Deal Volumes: The first half of 2024 has seen a marked decline in M&A activity within the Consulting Services industry. PwC notes that total transaction volumes dropped by 25% in the first half of the year compared to the same period in 2023, continuing a downward trend that began in 2022 [1]. This decline points to the ongoing economic headwinds—including inflation, geopolitical risks, and rising interest rates—that have prompted a more selective, cautious approach to deal-making. Companies are choosing to be more strategic about the transactions they pursue, with many focusing on deals that offer immediate synergies or operational efficiencies.

- Shift from Expansion to Consolidation: The nature of deals has also evolved. Where firms once focused on expansionary M&A—seeking new markets or capabilities—there is now a greater focus on consolidation. Companies are leveraging M&A to streamline operations and reduce costs, particularly in sectors like technology and ESG consulting. Bain & Company highlights that while firms are still looking to acquire niche capabilities, the economic climate has made operational efficiencies a higher priority, contributing to the shift from expansion to consolidation [3].

- Valuation Pressures and Selective Deal Making: High valuations continue to pose challenges, especially in sectors with high demand, such as digital transformation and sustainability consulting. This has made firms more selective, waiting for favorable deal terms before proceeding with transactions. The reluctance to engage in overvalued deals has been a significant factor in the slowdown of M&A volume over the past year [3].

- Macroeconomic Challenges: The broader economic environment continues to exert significant pressure on M&A activity. Persistently high interest rates have squeezed returns and pushed dealmakers and investors to prioritize value creation stories over immediate results. While the risk of an economic recession could prompt central banks, to either start to cut or continue to cut interest rates (Canada has already executed three rate cuts in 2024). This may lower borrowing costs and stimulate deal-making. However, a weaker economy could pose as a counterbalance, making growth more challenging.

Consulting Industry Outlook

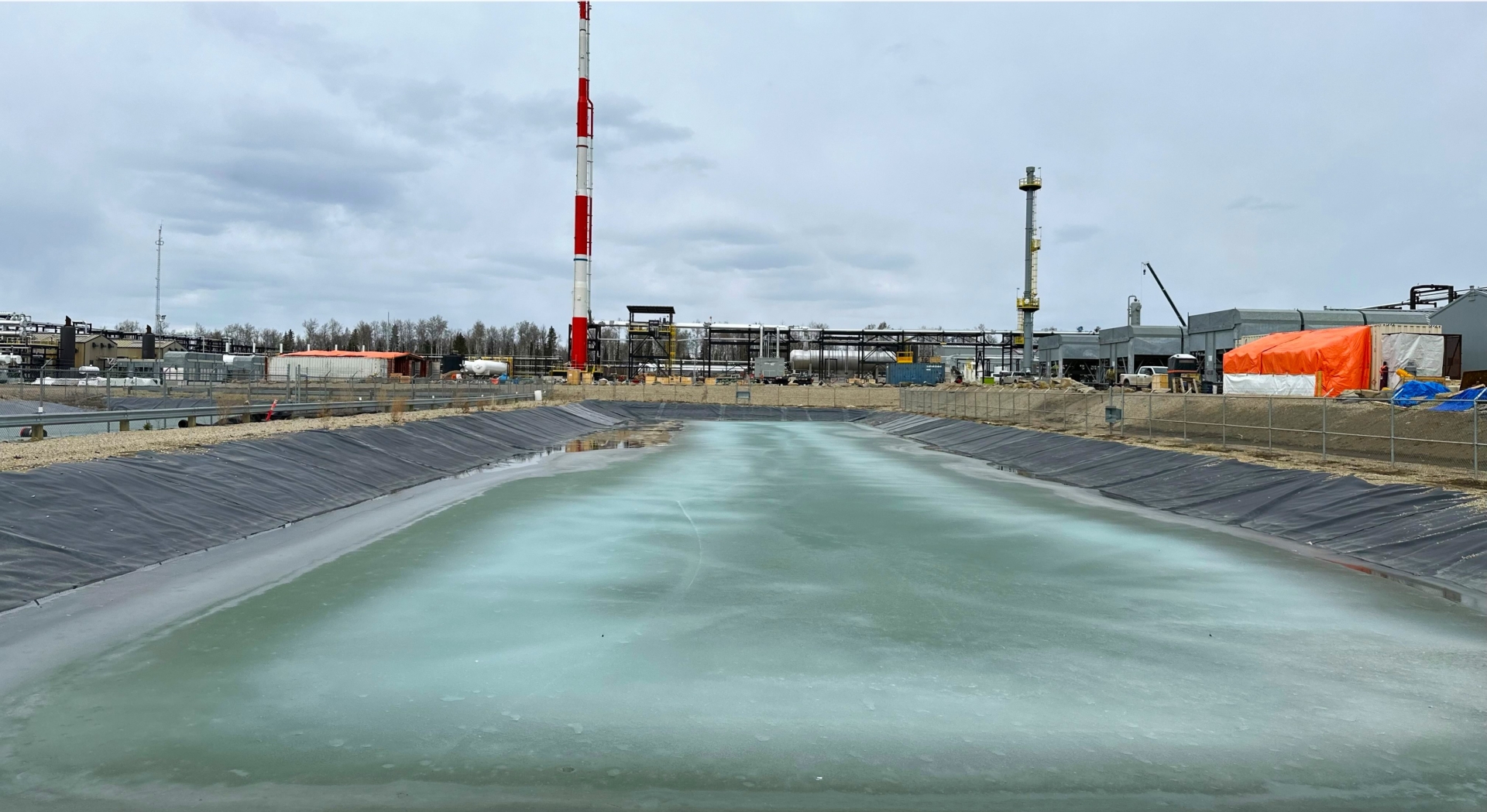

Okay, great, so the North American market is still very much in flux, but does this mean for the AEC (Architecture, Engineering & Consulting) Industry in particular?

In the April 2024 AEC Industry Survey, 54% of respondents indicated plans to pursue one or more acquisitions this year. This marks a significant increase from the 34% that made acquisitions in 2023, reflecting a broader sense of optimism for a market rebound. However, much like other sectors, the timing of M&A activity, particularly in the mid-market consulting sector, remains uncertain. While there is hope for a rebound in the second half of 2024, current economic and market conditions suggest that at least for the near term larger firms may anchor higher deal valuations, while middle-market transactions may remain muted.

However, as macro-economic clarity begins to emerge, we should anticipate a rise in deal volumes. Given that M&A deal cycles and thorough due diligence typically span six to twelve months, the rebound in activity could already be in motion. The market now awaits a tricky ingredient ‘certainty’ to push wider deal volumes in motion. With clearer macro-economic sightlines, the domino effect could swiftly set M&A activity back into full gear.

I have attached my sources below for anyone interested in reading further:

- PwC. (2024). Global M&A industry trends: 2024 mid-year outlook. Retrieved from: https://www.pwc.com/gx/en/services/deals/trends.html/global-ma.html

- McKinsey & Company. (2024). Top M&A trends in 2024: A blueprint for success in the next wave of deal activity. Retrieved from: https://www.mckinsey.com/capabilities/m-and-a/our-insights/top-m-and-a-trends-in-2024

- Bain & Company. (2024). Looking Ahead: How the Big Backlog Will Shape the 2024 M&A Agenda. Retrieved from: https://www.bain.com/insights/looking-ahead-m-and-a-report-2024/

Thanks for reading,

Patrick

About the Author

Patrick Bowyer, Financial Analyst

Patrick Bowyer is a key leader in driving financial planning, analysis, and mergers and acquisitions initiatives at 360. With a background in petroleum engineering, Patrick leverages his technical expertise and business acumen to develop strategies that support organizational growth and operational excellence. His experience spans financial modeling, strategic acquisitions, and business development across various industries. He is a graduate of both the Southern Alberta Institute of Technology and the University of Wyoming, where he earned his Bachelor of Science in Petroleum Engineering.