The focus on asset retirement obligations (ARO) in the oil and gas industry has risen steadily since 2015. There is a multitude of factors as to why, with the Redwater case and the eventual decision by the Supreme Court of Canada at the forefront. This has resulted in ARO now being one of the most prominent decisions corporately and in the acquisition and divestiture market.

Still, little has been done to standardize the calculation of ARO. A consequence of this oversight is that some companies have presumably understated their ARO. This is leading towards serious ramifications for a multitude of stakeholders and crystalizing the need for a standardized methodology for evaluating ARO.

How Can Companies Understate ARO?

It is important to understand how companies may understate ARO to identify discrepancies and drive corrective action.

The most common method for understating ARO is relying on the Licensee Liability Rating (LLR) values to calculate gross ARO costs. Many readers will rightfully acknowledge that downhole well abandonment costs are typically overstated by LLR, but the omission of remediation and pipelines from LLR overcomes this. Several recent studies from various industry groups have provided substantial evidence supporting this conclusion.

Some companies have tried to remedy this issue by applying historical costs across their portfolio to estimate ARO. Unfortunately, even this method can understate ARO because many companies tend to select lower-cost sites for closure but fail to consider this when extrapolating costs across their portfolio.

Companies may also understate ARO by estimating closure costs based on speculative, and thus unproven, improvements in technology, regulations, and practises. All three areas are experiencing rapid changes but calculating ARO assuming unproven cost savings is inappropriate.

A far less common practise is for companies to define remediation as a contingent liability and exclude the costs from ARO disclosures, arguing they do not know which sites will require remediation or how much it will cost.

Finally, companies may apply unrealistically long timelines for incurring closure costs to decrease the net present value of ARO. The regulatory framework on closure timelines has tightened in recent years and ARO assumptions must be revised to reflect these new realities.

How Does Understating ARO put Stakeholders at Risk?

It is paramount for our industry to recognize the risks associated with inaccurate ARO so that we can understand the impacts and develop solutions that support the future of our industry.

Management and Directors

In Alberta, section 106 of the Oil and Gas Conservation Act provides the AER with authority to hold directors and officers responsible for debts outstanding to the AER or Orphan Well Association (OWA), which includes unfunded liability. Failure to settle these debts impairs a person’s ability to occupy a management or director position in the future. Management and directors also face enormous reputational and potential legal risks now that Redwater has prioritized ARO over other obligations in insolvency. We wonder how long it will be before an impacted investor launches a legal action against the management and directors of a failed corporation for a material misstatement of ARO?

Shareholders and Investors

The risk exposure for shareholders and investors increased monumentally from Redwater and many investments made prior to the decision are now severely underwater due to ARO. Similarly, the profit model of equity investments has been impacted due to reduced cash flow projections and the inability to divest assets.

Governments and Landowners

Governments were largely shielded from the direct impacts of understated ARO when industry agreed to fund 100% of the OWA in the early 1990s. However, the landscape has shifted in the past few years and one can point to the 2020 Federal funding initiatives (SRP, etc.) as an indicator of this. The long-term risk to government is still unproven but many believe that taxpayers will ultimately be responsible for some portion of unfunded liability.

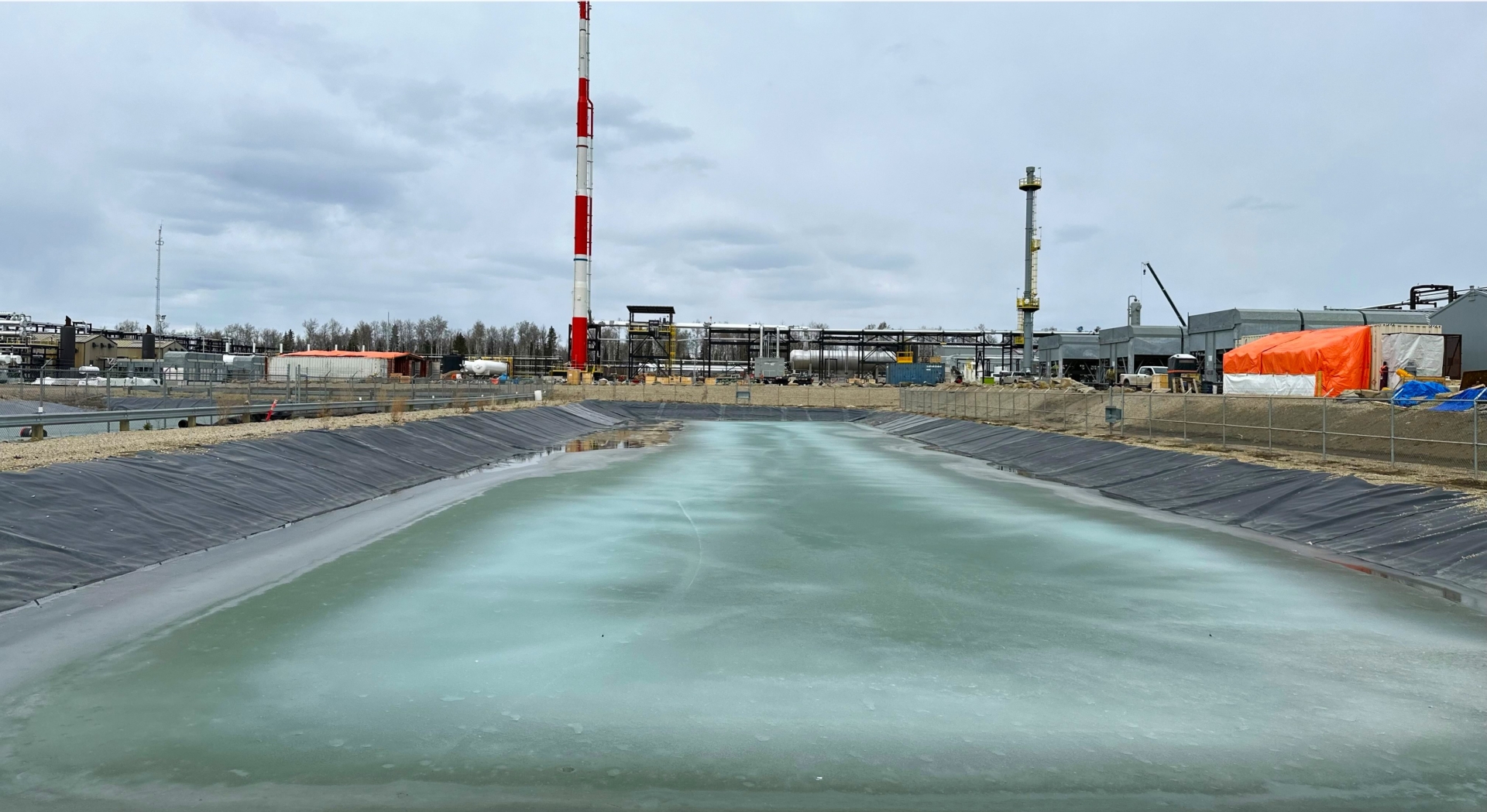

Landowners are directly impacted by understated ARO through orphaned and inactive sites on their lands, of which a portion has integrity and contamination concerns that pose serious public health and environmental risks.

How Can We Correct this Issue?

The need to correct ARO evaluation is paramount for the long-term health of our industry and should be viewed as a key pillar in restoring investor confidence and assuaging environmental claims against the industry. The successful methodology must be reliable, transparent, and suitable for all of industry.

The keys to standardizing the evaluation of ARO are:

- A committed effort from all industry stakeholders that emphasizes the long-term sustainability of the industry.

- The collection of data and application of statistical analysis to develop a model that is accurate and widely accepted.

- Stratification of assets into analogous groups to eliminate distortion from selection bias.

- Normalization of historical results to current regulations, technology, and processes.

- Application of suitable timelines for closure in alignment with the current regulatory framework (i.e. Area-Based Closure Program, Dormant Site Program, etc.).

- Incentives from supporting industries and services.

Our industry is part of a transforming world that is demanding changes to the status quo. Prospering during this energy transition will require our industry to evolve and adopt systems that support where we are today and where we are going in the future. It must not be overlooked that the adoption of a standardized methodology for ARO evaluation will be painful for a portion of the industry and resistance is to be assumed. However, the impacts of doing nothing and hoping it becomes someone else’s problem can no longer be ignored.

Yours in Liability,

Mike